Cardano (ADA) has recently faced a decline in price, with the token hovering at around $0.65. Despite some attempts to recover, the altcoin’s future remains uncertain.

Investor support is critical at this juncture, and if key ADA holders decide to sell, the situation could worsen for Cardano’s price.

Cardano Holders Exhibit Skepticism

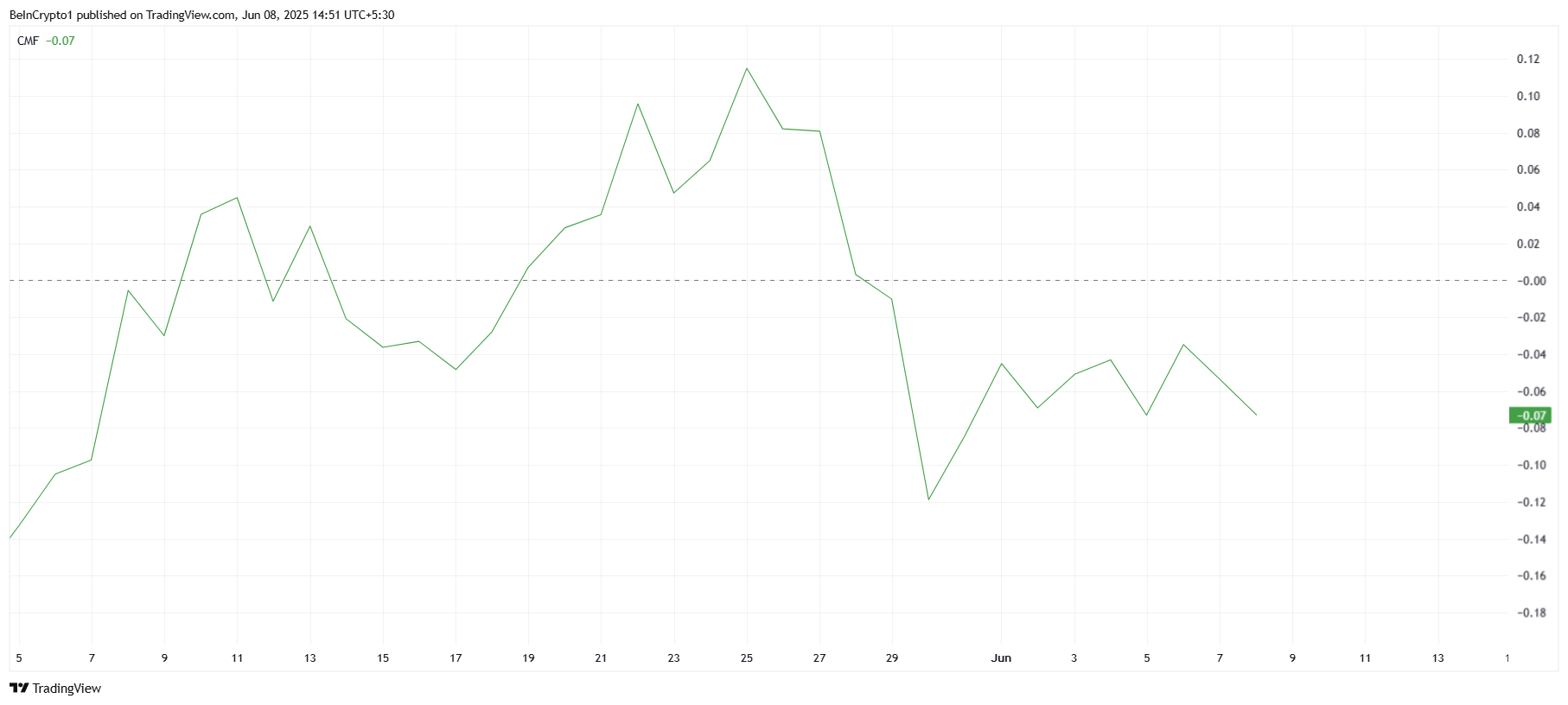

The Chaikin Money Flow (CMF) is currently sitting in the bearish zone, below the zero line. This indicates that outflows are active, suggesting that investors are selling off their ADA holdings.

The bearish reading on the CMF signals uncertainty about Cardano’s future prospects, with investors moving to reduce their exposure to the token.

The persistent outflows point to growing skepticism among ADA holders, particularly as the broader market remains volatile. As investors lose confidence, there is an increased risk that more holders will choose to liquidate their positions.

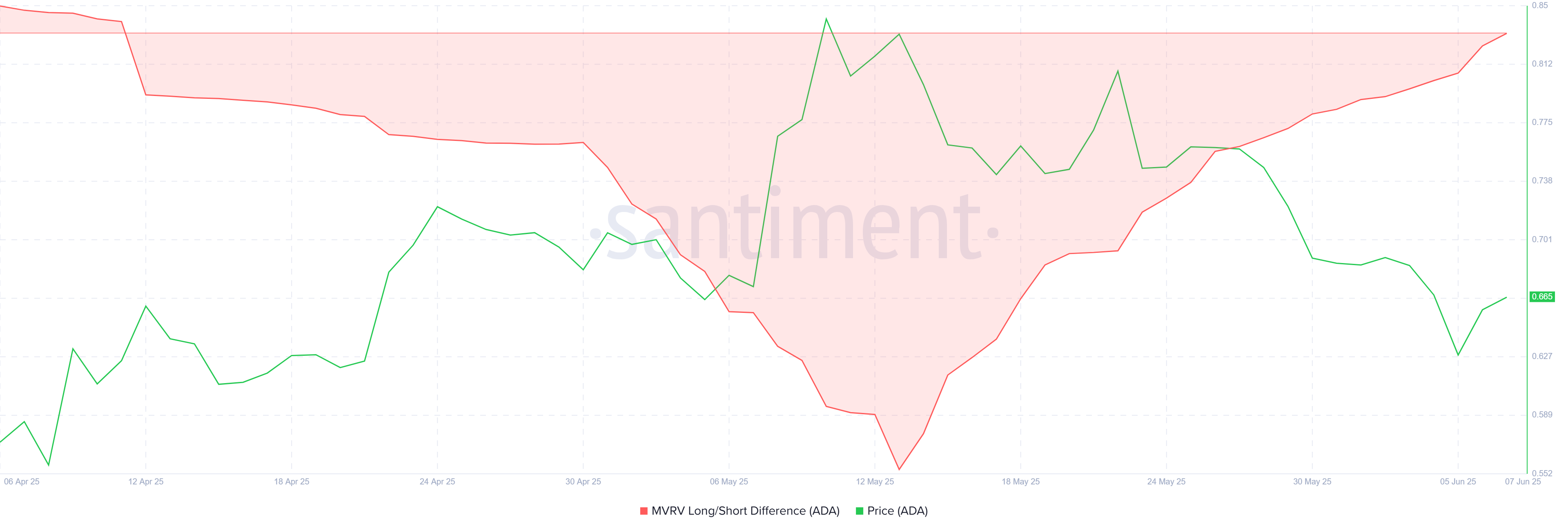

Looking at the overall momentum, the MVRV (Market Value to Realized Value) Long/Short Difference shows that profits are shifting from short-term holders (STHs) to long-term holders (LTHs).

This is generally considered a positive sign, as it indicates that long-term investors are holding onto their assets.

The skepticism among ADA holders may play a key role in determining whether the MVRV shift leads to a bullish or bearish scenario.

If LTHs choose to sell their holdings in response to market pressures, it could result in a wave of selling, further depressing Cardano’s price.

ADA Price Decline Is Possible

At the time of writing, Cardano’s price is at $0.65, with the token hovering around the critical $0.66 resistance level. This level is key for pushing the price higher toward $0.70.

However, the mixed signals from the market and investor sentiment suggest that ADA may struggle to break through this barrier.

If ADA fails to secure $0.66 as support, it could fall to $0.60, further extending the price decline.

The Parabolic SAR is currently above the candlesticks, signaling bearish momentum. This indicator suggests that Cardano may not have the strength to push through the resistance, and a decline could follow if support is lost.

However, if Cardano manages to break past the $0.66 resistance, the price could rise to $0.70 and potentially beyond.

If $0.70 is breached in the coming days, it would open the door for a move to $0.74, invalidating the current bearish outlook and restoring investor confidence in ADA’s future potential.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.